Medicare Supplement

Need Help Covering The Costs Original Medicare Doesn’t? Medicare supplemental coverage is the right choice for you.

Reduce Your Out Of Pocket Costs.

Get The Treatment You Need.

A Brief Overview Of Original Medicare – Part A & Part B Coverage

Medigap Coverage Facts:

• Medigap coverage is designed to supplement your Original Medicare Coverage.

• It covers a certain percentage of your copayments, coinsurance, deductible, excess charges & blood transfusion costs.

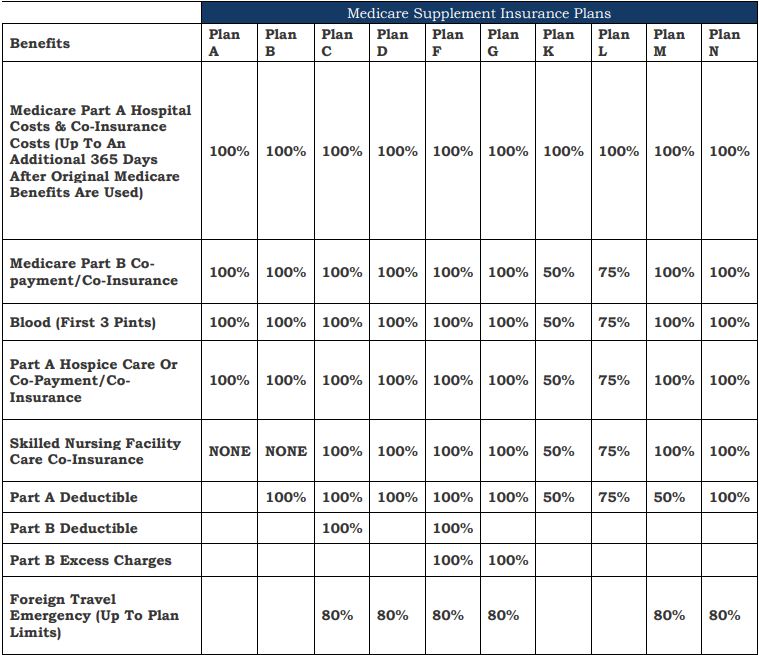

• The limitations of this coverage & the percentage that it covers you depend on which plan you choose.

Medicare Supplemental Coverage with Jeff David

What Does Medicare Supplement Coverage Help Me Pay For?

Medicare Supplement Coverage Helps You Cover A Certain Percentage Of These 9 Costs, How Much Depends On The Specific Plan You choose:

• Medicare Part A Coinsurance & Hospital Costs

• Medicare Part B Coinsurance & Copayment

• Blood (first 3 pints)

• Part A Hospice Care Copayment Or Coinsurance

• Part A Deductible

• Part B Deductible

• Skilled Nursing Facility Care Coinsurance

• Part B Excess Charges

• Foreign Travel Emergency Coverage

Medigap Plan Details

Click here to download all plan’s coverage details. Use it as a reference for further details below!

• The most affordable plan but has the fewest individual benefits (not to be confused with part A Original Medicare coverage).

• Only 4% of people choose this policy.

• If you anticipate needing health services frequently, this plan may not be the best option.

• Insurance companies that provide Medigap plans must include this plan, despite its lack of enrollment interest.

• This plan is similar to a slightly upgraded plan A. Affordable but lacking in benefits. (not to be confused with Original Medicare coverage)

• Offers fewer benefits than most available plans.

• Only 3% enrollment in 2014.

• Covers everything plan A does & the Part A (Original Medicare) deductible.

• Offered by about 60% of providers.

• This is the 2nd most popular Medigap option.

• Mid-range cost insurance plan.

• 5th lowest monthly premiums out of 10 available plan options.

• Widely available – insurers must offer plan C or plan F if they want to provide plans outside of plan A.

• Covers 8 of 9 (see table above) available Medigap benefits – everything but part B excessive charges.

• Suitable for Medicare beneficiaries who expect to need medical care frequently & worry about the cost of co-pays & deductibles.

• Although it’s middle of the line in cost it has great benefits.

• About 10% of policyholders choose this option – becoming less popular (6% in 2014)

• This plan is offered by about half but only chosen by about 2% of policyholders.

• Covers 7 of 9 possible benefits (see table above) – Not Part B deductible or excess charges.

• Like plan N, greater benefits than plan A or B.

• This plan is the most popular option, over half of the policyholders (56%) choose this option.

• Popularity and coverage cost vary widely among states ($79-$220 monthly).

• On average one of the most expensive options.

• High deductible version available – saves you money on monthly premiums.

• If chosen must meet a year deductible of $2,340 (2020) before it covers anything. May have a lower premium, but will have much higher out of pocket costs.

• To evaluate this choice you need to consider how likely you are to use enough medical services to meet the yearly deductible, then evaluate how much coverage you would need after the deductible is met.

• Covers all 9 (see table above) of the available Medicare Supplement Insurance Benefits.

• Covers most out of any of the standardized plan options.

• May be suitable for you if you need extensive medical coverage and don’t want to worry about co-pays and deductibles.

• Covers all Medigap benefits except Part B deductible (see table above).

• Chosen by about 6% of policyholders (2014 data).

• Average premiums are on the higher side but this plan good coverage.

• May be an option for you if you’re more concerned about part A rather than part B out of pocket costs.

• This Is Becoming A More Popular Option – fits many peoples needs.

• Cost sharing plan – some of the costs aren’t fully covered, similar to Plan L (but with higher out of pocket cost limits & lower coverage percentages (50% as compared to 75% respectively).

• Out of pocket limit is $5,560 in 2019.

• Covers 50% of:

• Part A&B coinsurance and copayment costs.

• First 3 pints of blood transfusion.

• Part A hospice care costs.

• Skilled Nursing Facility coinsurance costs.

• Part A deductible.

• Not commonly offered or used, only offered by 16% of providers and held by 1% of policyholders.

• This plan has cost sharing of 75%

• Covers 75% of:

• Part A&B coinsurance and co-payment costs

• First 3 pints of blood transfusion

• Part A hospice care costs

• Skilled Nursing Facility coinsurance costs

• Part A deductible

• More difficult to find – only offered by 16% of companies.

• This plan is held by less than .5% of policyholders.

• This is a relatively new plan – introduced in 2010 (least popular and rarest provided as a result).

• Only plan that offers full & partial coverage

• Partial: 50% of part A deductible costs

• No coverage: part B deductible & excess charges

• Mid-range plan – like plans N & D

• Only offered by 9% of companies & held by less than .5% of the market

• This is the third most popular Medigap plan – about 7% of policyholders have this plan

• Covers 7 of the 9 available benefits (see table above).

• Subject to two co-payment structures, requiring up to $50 for certain emergency room visit and up to $20 for physician office visits.

• This effects the Part B coinsurance & co-payment benefits

• This plan is identical to plan D except for the Part B exceptions

• Fastest growing Medigap plan

Other Questions

What else should I know about supplement plans?

• You must have both Parts A & B.

• You pay the private insurance company a monthly premium for your policy in addition to your part B premium that you pay to Medicare.

• There are out of pocket limits

• Policies only cover one person, if your spouse would like one, they will have to buy separately.

• You can’t have prescription drug coverage in both your Medigap policy and a Medicare drug plan at the same time. You must choose one or the other, even though your provider may offer both.

• It’s important to compare Medigap policies since costs can vary between companies. These may also go up as you get older.

When To Buy?

• Best time to buy a Medigap policy is during your Medigap Open Enrollment Period.

• Medigap Open Enrollment: 6-month period begins on the first day of the month in which you’re 65 or older & enrolled in Part B (Some states have additional periods). After this enrollment period you may be unable to purchase a Medigap policy, or it may cost more (similar to enrolling late in Original Medicare).

• If you delay enrolling part B because you have group health coverage based on your spouse’s current employment your Medigap Open Enrollment period won’t start until you sign up for part B.

• Federal law generally doesn’t require insurance companies to sell Medigap policies to people under 65. If you are under 65 you be unable to purchase the Medigap policy you desire. If your state does allow you to buy one, it may cost you more.

Am I Eligible?

You Are Eligible If…

• You Are Enrolled In Original Medicare Parts A & B

• Are 65 Or Older

• Have A Disability

• Have late stage renal disease

• You DO NOT Have A Medicare Advantage Plan

When do I Sign Up?

You Can Sign Up During…

• Open Enrollment (highly recommended)

• The 6 Month Period Following The First Day In Which You’re 65 Or Older & Are Enrolled In Part B

• After This Period You May Be Unable To Purchase Medigap Coverage Or It May Cost More.

Do You Need Extra Assistance?

If your income & resources are below a certain threshold you may qualify for extra help or medicaid or both. Please click here (Link) to learn more if you feel this applies to you.

Choosing the right medicare plan can be difficult.

Our Easy Step By Step Plan

.

Just follow our easy step by step plan to peace of mind about your coverage

1. Call us & speak with a licensed agent.

2. Tell us what you are looking for from your coverage.

3. We’ll set up an appointment for you.

4. We’ll design a plan together that fits you.

5. We get you signed up.

6. Go from concerned to worry free!